I just ran across this post by Dr. Murray Sabrin, in which he presents the text of his testimony on the budget before the state Senate Budget and Appropriations Committee. He's got some interesting ideas about how to fix the state's budget problems.

On education funding:

• Amend the Constitution to abolish the “thorough and efficient” education clause, giving the Legislature control over school spending

• Amend the Constitution preventing the Supreme Court from ordering the Legislature or the executive branch to spend money for any purpose

About the only way to get the Supreme Court out of the school funding business is to explicitly invalidate Abbott and prevent it from coming back.

• Equalize state education aid. Every school district would get the same state aid per student as every other school district

This one I really like. The only truly fair way for the state to fund education is by linking the money to the students, rather than the schools or districts. Of course, it introduces other problems like inflation of attendance records.

• Implement education tax credits for individuals, families and businesses

Tie this to the previous item. Give the individual student or his parents gets a voucher that can be spent at any school in the state. [My, I'm starting to sound like a Libertarian, aren't I?]

On financial management:• The state should implement forensic accountants Rosenfarb Winters recommendations regarding the Abbott Districts, which would save at least $282 million

Kinda cryptic reference, but I like the idea of saving 9-figure numbers.

• Institute zero based budgeting—all state agencies must justify every dollar it spends

We do this today, except the justification is usually "That's what we spent last year, you got a problem with that?"

On specific taxes:• Reduce the sales tax by one cent every year for three years

Like it, but I'd go for six rather than three years.

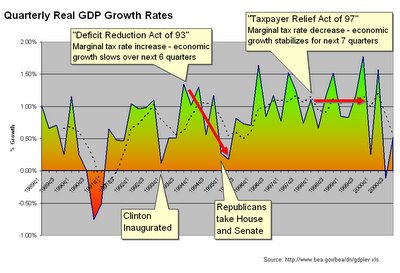

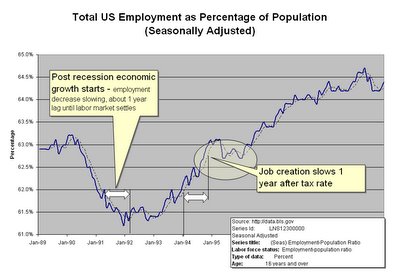

• Reduce the personal income tax and the Corporate Business Tax

This is good, as long as we reduce the marginal rates to stimulate growth, rather than creating some phony scheme that eliminates taxpayers from the rolls. Unfortunately, the Governor has proposed option B.

• Eliminate the income tax on pensions

I don't know that this is such a good thing (see above re: eliminating taxpayers from the rolls)

• Raise the gas tax 20 cents per gallon only for road and bridge projects

More than doubling the gas tax (or any other tax) is a Bad Idea™.

On redistribution schemes:• Eliminate property tax rebates, saving $1.5 billion per year

Great idea, as long as it's enacted along with the linkage of funds to students.

• Eliminate all state grants to nonprofits

Makes sense to me. I don't want my money funding West Jepepian Cultural Studies or other such nonsense. Many nonprofits do good work, but they all employ professional fundraisers and should not be reliant on state grants. Fee for service paid to nonprofits, however, would probably be a more efficient use of state tax dollars.

• End municipal grants

I don't think that I would completely eliminate them, but I would like to see tighter controls and elimination of favoritism toward committee chair pet projects. Transparency would be nice here.

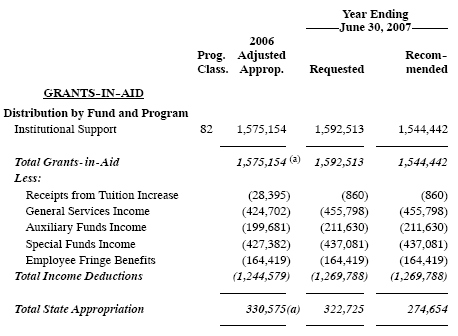

On specific spending items:• Begin the transition making the state colleges, Rutgers University, and the University of Medical and Dentistry of New Jersey financially independent

Considering the facts

that Rutgers charges $237 per undergraduate credit hour in state ($484 out of state), has

28,000 students enrolled, and

requires 120 credit-hours of course work to graduate, one would think they could generate a viable business model without state funding. By my back-of-the-envelope calculations, they take in somewhere around $200 million annually from tuition alone, assuming an 80/20 split between in-state and out and 4-5 years to graduate.

• Kill the Transportation Fund bond issue

All for this one, as well. The debt liabilities in the TTF need to be taken out of hide, like they should have been when they were incurred.

On fixing the business climate:• End state government grants, loans, subsidies for businesses

• Abolish unnecessary business regulations

Absolutely. The state has no business in business. Set a low tax rate, keep it stable, get out of the way and watch things take off.

On general government reforms:• Eliminate dual office holding

How the heck did we end up with this albatross, anyway?

• Eliminate pensions for part-time government employees

I spend at least an hour a year on paperwork for the benefit of the state, and in return I get a check. Is that enough to qualify me as a state employee for pension purposes?

• Eliminate pensions of legislators

I'm absolutely in favor of doing away with the permanent politician. Killing these pensions would remove a significant incentive for those in office to stay in office.

It's not surprising that Sabrin's ideas haven't gotten more attention, given that he was 51st on a

list of 74 people testifying April 3rd, and has been a less-than-successful candidate for multiple statewide offices (Governor 97, Senate 00). I'll leave you with Sabrin's thoughts on the true source of our problem, with which I wholeheartedly agree.

The culture of entitlement and redistribution of income is so ingrained in the collective psyche of policymakers and many segments of the public, that few individuals can conceive of a society based on low taxes, less spending, less regulation, and limited government. Instead, too many of our citizens believe government’s prime responsibility is to be the social worker, the healthcare provider and the source of income for many of our families.

Policymakers must embrace economist Ludwig von Mises’s insight: “The government and its chiefs do not have the powers of the mythical Santa Claus. They cannot spend except by taking out of the pockets of some people for the benefit of others.”

Tags: New Jersey,

Taxes,

Budget