Smackdown

Chanice at New Jersey for Change really lays into Steven Pressman for his article calling for higher income taxes in New Jersey. She says to read the whole article, and you should, but here's his opening salvo to wet your whistle:

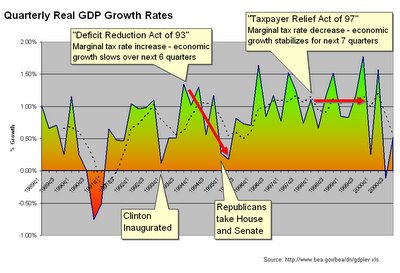

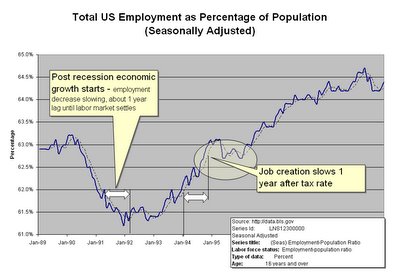

In 1993, when President Clinton took office, the U.S. economy faced an enormous budget deficit. His response was twofold. First, he increased income taxes on the wealthiest Americans. Second, he increased the tax on a gallon of gasoline. To help poorer families pay for the higher gas taxes, he increased the earned income tax credit — a tax break for low-income households where someone works.I always love it when liberals engage in the fallacy of post hoc, ergo propter hoc. It's even more fun when they include no data to support their assertions. Here's what Pressman leaves out. According to data from the Bureau of Economic Analysis, real economic growth was accelerating throughout 1993, from 0.12% in the 1st quarter to 1.35% in the 4th. In the 8 quarters leading up to implementation of Clinton's marginal rate increase, average real growth was 0.82% per quarter. In the 8 quarters following (Q1 1994 to Q4 1995), average real growth was 0.76%. The rate increase did not create "the longest economic expansion in U.S. history," it slowed an expansion already underway. Here are some handy charts to illustrate. The first shows real GDP growth from the BEA data linked above, while the second is the percentage of the population employed according to the Household Survey, from the Bureau of Labor Statistics.The result of these actions was the longest economic expansion in U.S. history. Unemployment dropped to below 4 percent, a level rarely seen in this country. And perhaps most important of all, a massive government budget deficit became a huge budget surplus, which has since been squandered by President Bush.

As shown in the national data, increasing marginal income tax rates tends to suppress, not encourage, real economic growth. Pressman asserts that higher tax rates cause economic growth, which is demonstrably false. The rest of his argument for curing New Jersey's budget ills, based on this fallacy, doesn't hold water.

The only way out of this mess is to grow spending at a slower rate than we grow revenue. Until the governor proposes (and the legislature enacts) a plan that will constrain the spending side of the equation, we will never win.

Tags: New Jersey, Taxes, Budget

|