Carnival of the New Jersey Bloggers, Number Fifty

Folks, I wanted this to be an extra-special fiftieth anniversary edition of the Carnival of the New Jersey Bloggers. I had all kinds of great plans for a themed carnival, featuring a song parody with links to all the submitted posts.

Two problems arose. One, my song parody just never came together. As a matter of fact, it sucked. Here's a sample, judge for yourselves:

Fifty Ways to Blog New Jersey1

The problem is all inside your head, she said to me

The answer is easy if you take it logically

I'd like to help you in your struggle to be free

There must be fifty ways to blog New Jersey

She said it's really not my habit to intrude

Furthermore I hope my meaning won't be lost or misconstrued

So I repeat myself, at the risk of being crude

There must be fifty ways to blog New Jersey

Fifty ways to blog New Jersey

Refrain:

Just leave her for him, Jim, get a new job, Bob

Don't try a new con, Jon, just listen to me

Trip on the rug, Doug, don't need to discuss much

Pump your own gas, lass, and get yourself free

The second problem is one every blog carnival host should face -- a whole mess of links. Getting them all to fit inside the confines of a single song would have been completely impossible, so I'll just do this the old-fashioned way. We've got a nice mix this week of regular contributors, old friends who've been away, and even friends we hadn't met yet. Let's start with them, after a nice glass of wine while we all get acquainted.

The New Folks

Several blogs were brought to my attention for the first time this week. As far as I can tell, these are their first visits to the Carnival. Please welcome them warmly and with many future links. First up is The Jersey Todd Show, a podcast blog covering the music scene. In Todd's own words from Episode 29, he's got "bands you've heard of, bands that you haven't heard of, bands you're absolutely going to fall in love with."

Corzine Watch take's the governor at his word ("Hold me accountable"), tracking his promises vs. performance. Just yesterday, they covered gas station attendants, speed limits, approval ratings, and college tuition rates. It's amazing what the governor has influence over.

Disconnect the Dots presents "OCD-enhanced analysis of the major flaws that surround us every day," and his submission this week explores the flaws inherent in today's internet.

Finally, Schadenfreude of The Fifth Column ("Bloggas with Attitude") chimes in with A Fistful of Pennies, in which money becomes an issue for some people.

The Prodigal Sons

A few folks who've visited, and even hosted in the past dropped by after long absences. Mr. Bingley of the Coalition of the Swilling starts us off by sharing his life experience with extreme punctuality. Two hours early for a first date?

Dan Riehl, in the meantime, stops blogging national events and news long enough to notice New Jersey's Attorney General. I guess asking her to enforce the law is a bit of a stretch, isn't it?

Next up is Steve Schippert, formerly of The Word Unheard. Steve has a successful new gig at Threatswatch.org, where their motto is "Supporting Security by Enhancing Awareness." Steve sends us a story about Stolen Honor Reclaimed, which is really a story about how milblogs are changing the landscape.

The Usual Suspects™2

Many of our regular contributors have stopped in this week talking about tolerance (The Opinion Mill), loss (Shamrocketship), theft (The Nightfly), shopping (The Art of Getting By), and finance ("D"igital Breakfast). Mike Hill gives us a chapter from his novel (Sluggo Needs a Nap), while Jim expounds on the glut of holidays (Parkway Rest Stop). Kate of Katespot had quite a scare this week, but fortunately Moira's fine.

Dmitri from Cobweb Studios shares another beautiful photographs, while Princess Tata gives us some disturbing images.

Gasoline prices are an understandably hot topic this week, given the near-three-dollar price for regular. Joe's Journal the Center of New Jersey Life, and The Contrarian weigh in.

Joe also highlights the ACE Project, promoting alcohol awareness at Monmouth University. Joe's brothers in the fraternity are taking up a heavy burden trying to prevent acute alcohol poisoning, and should have gotten some recognition for their efforts. Joe's blog was the only media covering their kickoff event -- nicely done, Joe!

Music makes an appearance at The 15.24 Meter Blog, with memories of Kung Fu Fighting and other great songs from 1974. The Rix Mix also talks a bit about Neil Young, folk music, and calendars.

Gil's got literature, travel, and shaving covered at Virtual Memories, and celebrates an important anniversary with some thoughtful introspection. Also in a literary state of mind, Maureen of Jersey Writers passes on a little advice via Dorothy Parker's resume.

Chanice covers New Jersey politics, especially in the big cities. Today's target: Newark and the Housing Authority.

Karl in Atlantic City agrees with President Bush (and Fausta) about the national anthem -- sing it in English! Speaking of Fausta, she doesn't like Airbus' idea of standing up in an airplane for multi-hour flights. I can't say I blame her, those "seats" look more like vertical coffins with windows.

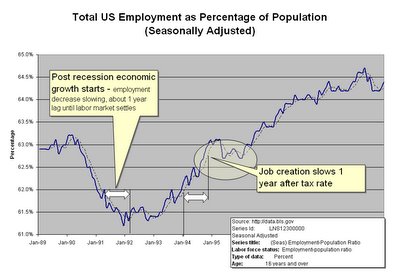

Surprisingly, Sharon and Enlighten don't agree on an issue of taxation. There's more to it than just taxation, but you need to read both posts to really understand the differences.

In items about the news business, Danny Klein notes The Jersey Journal's appearance on the Sopranos, while Jay Lassiter was an officially credentialed blogger for today's protest rally in NYC.

Government intrusion into our daily lives? Bob's got that covered.

On the international front, Jane keeps up her relentless blogging for freedom in Yemen. If half of us worked this hard at our blogging, the newspapers would just fold up and go away.

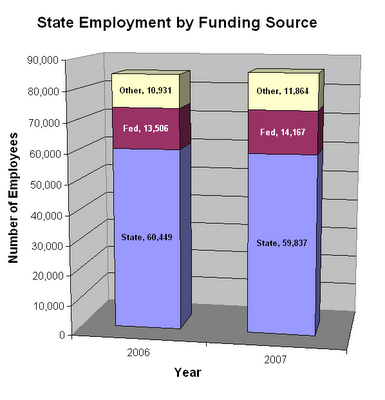

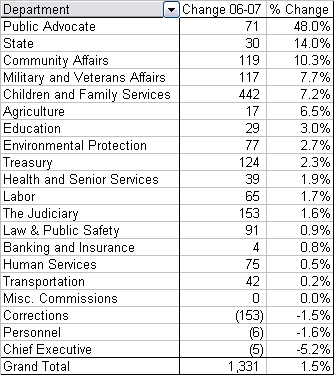

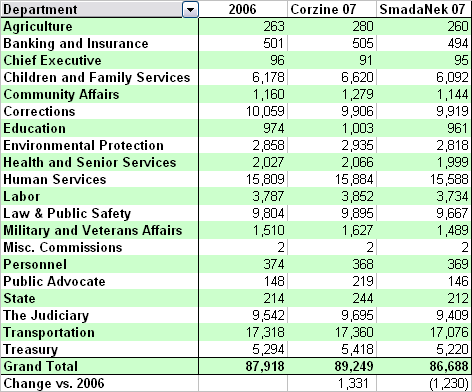

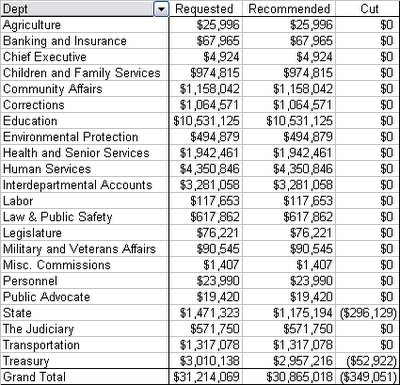

I've got two final thoughts to leave you with. First, please read my post about the state's "hiring freeze." The numbers will send a chill up (and down) your spine. Then, stop by to see Mel for a good chuckle, and have a great New Jersey week!

Next week's Carnival of the New Jersey Bloggers will be hosted by The Fifth Column. As always, submit your links to NJCarnival@gmail.com.

1 With apologies to Paul Simon (who was born in Jersey)

2 With apologies to Jim

Tags: Carnival of the New Jersey Bloggers